The Motorhome Blog

Welcome to the motorhome blog from Comfort Insurance!

As motorhomers ourselves, we are constantly learning new tips from and sharing our own experiences with the wider community and with new friends we meet while out on the road.

That’s why we started this motorhome blog – as a place for our customers to find useful resources which can help them to get even more out of the motorhome lifestyle.

Here at Comfort, we understand that there will be some reservations with taking your family away on a motorhome trip for the first time, but they are actually fantastic because of the freedom and flexibility they give. Our blog posts will cover everything you need to know about motorhoming with the family and kids.

Comfort Camping Cookbook

Our Latest Blogs

5 of the Best Winter Motorhome Adventures

In general, the summer months are the busiest for motorhome sites and travel, with many travellers preferring to hit the road while the weather is...

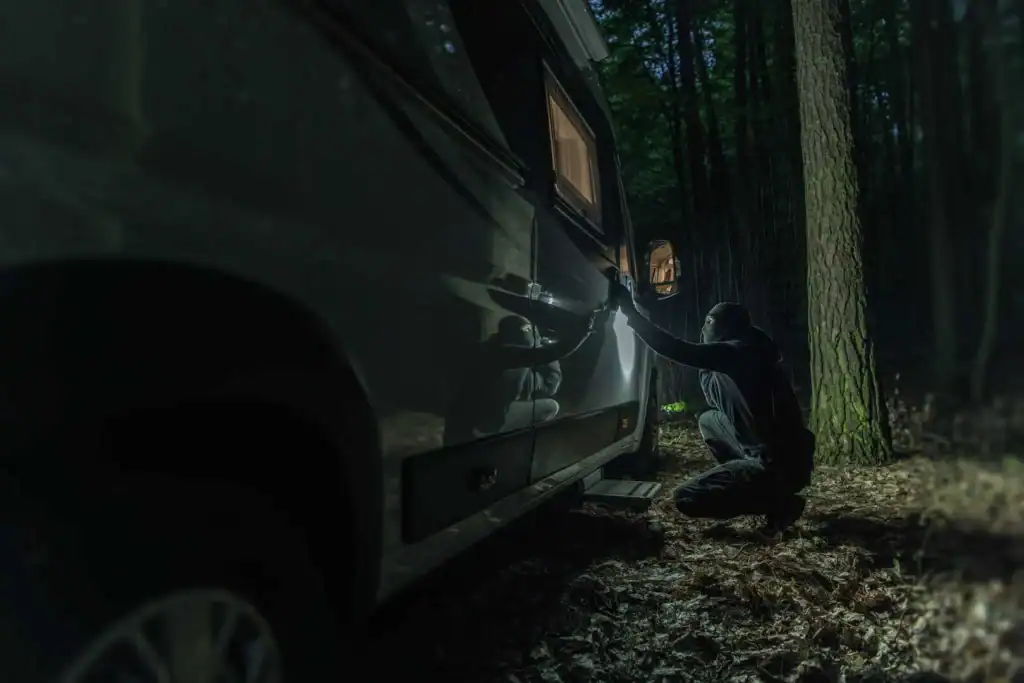

What to do if your Motorhome or Campervan is stolen?

For many people, a motorhome or campervan is their most valuable asset after their home and for some, it’s their most expensive possession all together....

Tour of the UK’s Best Christmas Markets 2025

With the festive season in full sparkle, there’s no better way to soak up the magic than bundling into your campervan or motorhome and touring...

Comfort 30 Year Anniversary Cookoff Challenge – Help us choose a winner!

To celebrate the 30 year anniversary of Comfort Insurance we challenged our team with creating a Comfort themed sweet or savory treat that captures our...

Is It Time to Replace Your Motorhome Tyres? When to Replace your Motorhome Tyres & How to Spot Damage

Ensuring your motorhome or campervan has healthy tyres is crucial for smooth travelling. You should regularly inspect your tyres for any signs of damage and...

Fun Ideas for Celebrating Halloween on a Campsite

Looking for a fun way to spend Halloween with your family or friends this October? Why not take your Halloween celebrations on the road and...

An inside look into the Motorhome Market: Comfort Insurance Joins Insure TV to share Expert Insights

Comfort Insurance’s Director of Operations Ben Cue joins Insure TV to discuss the trends reshaping the motorhome industry. From changing travel behaviours and emerging customer...

New System for EU/European Travel that Will Affect UK Nationals – Explaining the Entry/Exit System (EES)

A new system is being introduced that will affect UK nationals traveling to the EU and Europe. If you’re planning on travelling abroad, including driving...

We Came, We Crammed, We Conquered – Our VW Campervan World Record 10 Years On

We can’t believe it’s been a decade since we squeezed, squashed, and sardined our way into the Guinness Book of World Records. With the help...

The Motorhoming Guide to Montenegro

Looking for your next unforgettable European road trip destination? In the heart of the Balkans, you’ll find the perfect hidden gem for motorhome and campervan...

Updates to European travel requirements for UK citizens– European Travel Information and Authorisations System (ETIAS)

Planning a European road trip in your motorhome or campervan? Make sure you’re aware of a new travel requirement expected to come in 2026. Following...

Comfort Insurance Awarded Best for Motorhome & Campervan Insurance 2025

The results are in and we’re thrilled to announce we’ve been named What Motorhome’s winner for Motorhome & Campervan Insurance Provider of the Year 2025!...

Possession of a Dash Cam is illegal in Portugal – Portugal warns tourists over popular device

It’s estimated that around a quarter of the UK’s drivers have a dash cam fitted in their vehicle. Millions of us have these security devices...

The Brexit 90-day Travel rule, Travelling in the EU and Schengen Zones Explained

With the passing of Brexit there is now more regulation for UK citizens when travelling in Europe. In this blog we’ll explain the Schengen agreement,...

Ideas and Tips for an Easter Getaway with the Kids

The Easter holidays are the perfect time for a family getaway with your kids or grandchildren, and what better way to spend the holidays than...

Could this popular cooking appliance be a potential fire hazard in your Motorhome? Best practices for using an Air fryer

In recent years the air fryer has become a cooking phenomenon! Reports[1] indicate that more than half of UK households now own an air fryer,...

Our Horizon Motorhome & Campervan Insurance Policy receives a Defaqto 5 Rating

We’re thrilled to finally announce that our Horizon Motorhome and Campervan Insurance product has received a Defaqto 5 Star rating! At Comfort we’ve been working...

Motorhome and Campervan Events 2025

Looking to get more involved in the motorhome and campervan community into 2025 and seeking thrilling shows and events to attend? Look no further! We...

Motorhome Blogs

Here at Comfort, we have plenty of blogs full of helpful tips and advice covering everything from travel guidance to staycation suggestions, motorhome buying to vehicle maintenance. Browse the categories below to help find blogs on the subjects you’re interested in.

Motorhome Where to Stay

Motorhome Weather

Motorhome UK Holidays

Motorhome Travel with Pets

Motorhome Travel Outside Europe

Motorhome Travel Europe

Motorhome Travel

Motorhome Storage

Motorhome Shows and Exhibitions

Motorhome Security

Motorhome Seasonal

Motorhome Safety

Motorhome News

Motorhome Manufacturers

Motorhome Maintenance

Motorhome Living

Motorhome Legal

Motorhome Insurance

Motorhome Hire

Motorhome Health

Motorhome Gadgets

Motorhome Finance

Motorhome Events

Motorhome Driving

Motorhome Campervan and Caravan Clubs

Motorhome Buying Advice

Motorhome Accessories

Campervan Blogs

Search through our different categories to find blogs to help you. Whether you’ve recently purchased a campervan or you’re a seasoned traveller, we have you covered with helpful information, recommendations, and guidance to assist you along the way.